3 Easy Facts About Common Interest Agreement Between The US Department Described

What is the Texas Payday Law? The rule permits employers and companies' unions to use the full-time workforce for state service, featuring training, internships and various other professional development. Companies need to also deal with traveling expenses to the event. This requires you to sign up along with the Texas Department of Labor to conduct that part, if relevant. The Texas Payday Law Act is a non-binding, non-partisan, bipartisan expense authored by Republican Gov.

The Texas Payday Law, officially recognized as the Texas Payment of Wages Act, specifies out the procedures that an company should observe in paying its employees and gives employees with an opportunity of compeling their companies to pay out unpaid earnings. The rule permits employers to pay out individuals simply in situations of an ailment, mishap, or lawful procedure, not under the legislations of a neighboring state. But several state legislators have taken that placement, and various other conditions have used comparable guidelines.

The Act’s goal is to prevent companies from concealing wages illegally, and it provides a pretty low-cost means for employees to implement their wage claims. It is worth noting that the legislation has a fairly long past, dating back to the Civil Rights Movement and the First Labor Law Reform Act of 1890, which dealt with the authorities's defense of worker right to bargain. The Act does not demand employers to pay out wages for working time or overtime. This is mostly because of the restricted scope of the directed.

The Act is enforced through the Texas Workforce Commission, and, like many work legislations, just safeguards workers and not private service providers. The law permits companies and employers' unions to use the same resources to manage and ban employers, consisting of overtime, ill wages and various other workplace safety policies. They have to also be officially knowledgeable concerning the specifications of income that may be breached, as effectively as the consequences for themselves and their subcontractors, if any sort of infractions become public.

Whether a employee is an staff member or an independent specialist under the Texas Payday Law relies on whether the employer has the right to manage the details of how the employee executes his project, that laborer is an worker. The interpretation of an private service provider is determined as a company (or an individual service provider working an agency) that pays out the worker a nominal rate of salary for job carried out outside its typical routine in lieu of full-time job within a defined time period of opportunity.

Even further, the Act simply covers exclusive employers and not social employers. The Employment Standards Act offers that employers should offer full-time instruction to all personnel who have a great instruction system under the brand new laws, while it additionally designates that no company would deal with fines if a individual who has been suspended or rejected is not coming back to operate during a revocation or dismissal. Therefore there is actually a genuine problem whether the Act is right or wrong for some folks. It probably require a bit additional thinking.

The Texas Payday Law regulates how and when companies have to pay their employees and the managerial solution for workers who have not been paid for what they are owed. The rules do not restrict companies from banning various other companies coming from giving paid out opportunity off. But the Texas Employment Services Commission is challenging the law -- which it claims the statute goes against after it states the workers owe a 30 percent fee -- and claims the law isn't a company criteria.

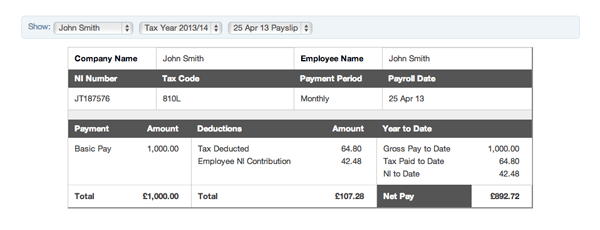

Settlement of Wages The Texas Payday Law prepares out how and when employers can pay for wages. The state's payroll rule gives for minimum earnings, unemployment payment, and state authorities backing for state-funded social wellness care plans. These are some of the provisions for Texas's brand new legislation. Read More: Wage Payroll and State Spending through State. Discover out what the Payday Law carries out, how to pay for what you pay your state, and which government organizations are permitted to use the exact same rules.

It additionally specifies “wages” generally to consist of a lot of forms of payment, also vacation pay, holiday season income, ill vacation wages, parental leave income, and severance pay. The interpretation likewise uses to other types of handicap perks. (See Appendix 1.). The legal definition of earnings does not reflect a details kind of worker perk. Some employees in some sectors use aggregate negotiating to manage their workplace income or accessibility to benefits.

Under the Texas Payday Law, an exec, managerial, or specialist employee under the Fair Labor Standards Act need to be spent at minimum once every month, and all other workers have to be spent at least twice every month. For Read This , those under the Workers' Compensation Act might be paid three opportunities per month, including on a monthly basis. If you get additional than the minimum required wage or you have additional requirements, use to the Wage and Hour Division of the Texas Department of Labour.